The Cost and Value of College

$60,356

That’s a solid annual salary.

So it’s no wonder many prospective students and their families are startled to see that’s also the sticker price for an undergraduate year at Pacific University, when tuition, room, board, fees and books are included.

Nationwide, headlines decry — appropriately — the rising expense of attending college and the associated student debt crisis.

As students and families face sticker shock — and tales of loan payments that rival mortgages, and fresh memories of a recession — it’s fair to ask:

What is the real cost of a college education? And, perhaps more importantly, what is the real value?

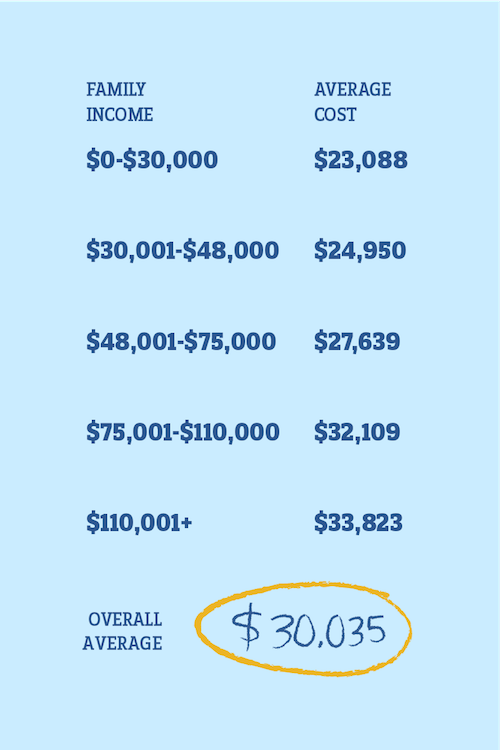

Average Cost for an Undergraduate Year at Pacific

Sticker Price vs. Actual Price

The $60,356 price tag isn't a number you’ll find on Pacific’s website. The figure is from the 2018-2019 Common Data Set, which colleges use to report data to the College Board and to publishers of college rankings.

In reality, very few undergraduates actually pay that price. Most receive substantial financial assistance — and much of it comes from Pacific itself.

In 2018-2019, Pacific undergraduates collected almost $40 million in university, federal, state or external grants. Of that, more than $34 million came from Pacific, most as tuition discounts — that is, tuition dollars the university offset with institutional grants and scholarships. For a first-year student at Pacific, the average discount hovers in the 50-percent range from year to year.

“If a student has a solid academic basis and they’ve done really well in high school, Pacific can be as affordable as a public institution,” says Leslie Limper, Pacific’s director of financial aid.

The problem is that, for many, the remainder still is not especially “affordable.”

That’s Still A Lot

On top of the $40 million Pacific students received in grants, they also received another $11.9 million in work-study grants and student loans — money they have to work for or pay back.

The nature of the financial aid system assumes that most students will borrow money for school, and the result is that, nationwide, student

debt stands at more than $1.56 trillion. That’s $1,560,000,000,000 — a number so large it registers only in abstraction.

It means the average member of the Class of 2018 nationally graduated owing about $30,000, which can, for many, mean deferring other major expenses, such as a house, apartment or car.

Long Term Loans Can Make a Difference

The financial aid process can be daunting, and it’s often the first experience students have with significant lending. Financial literacy and shopping through options is an important part of making the best long-term choices. For example, student loans often are structured to provide the lowest monthly payments possible, which can be enticing. On the other hand, that often increases the overall cost of the loan in the long-term. If you think of the $30,000 debt load as a car payment instead of a student loan payment, for example, you’d expect to pay less interest over a shorter period.

Is It Worth It?

A $30,000 debt is like buying a pretty high-end new car.

The difference, of course, is that a car depreciates, while the value of a college degree is only expected to rise. (Also, most car loans are at 5- to 7-year terms, while college loans are typically at a 20- to 30-year plan — so student loan payments are lower, but ultimately cost much more.)

The monetary value can vary depending on the student’s major and career goals. A lot of Pacific undergraduate alumni choose altruistic careers, in education or the nonprofit sector.

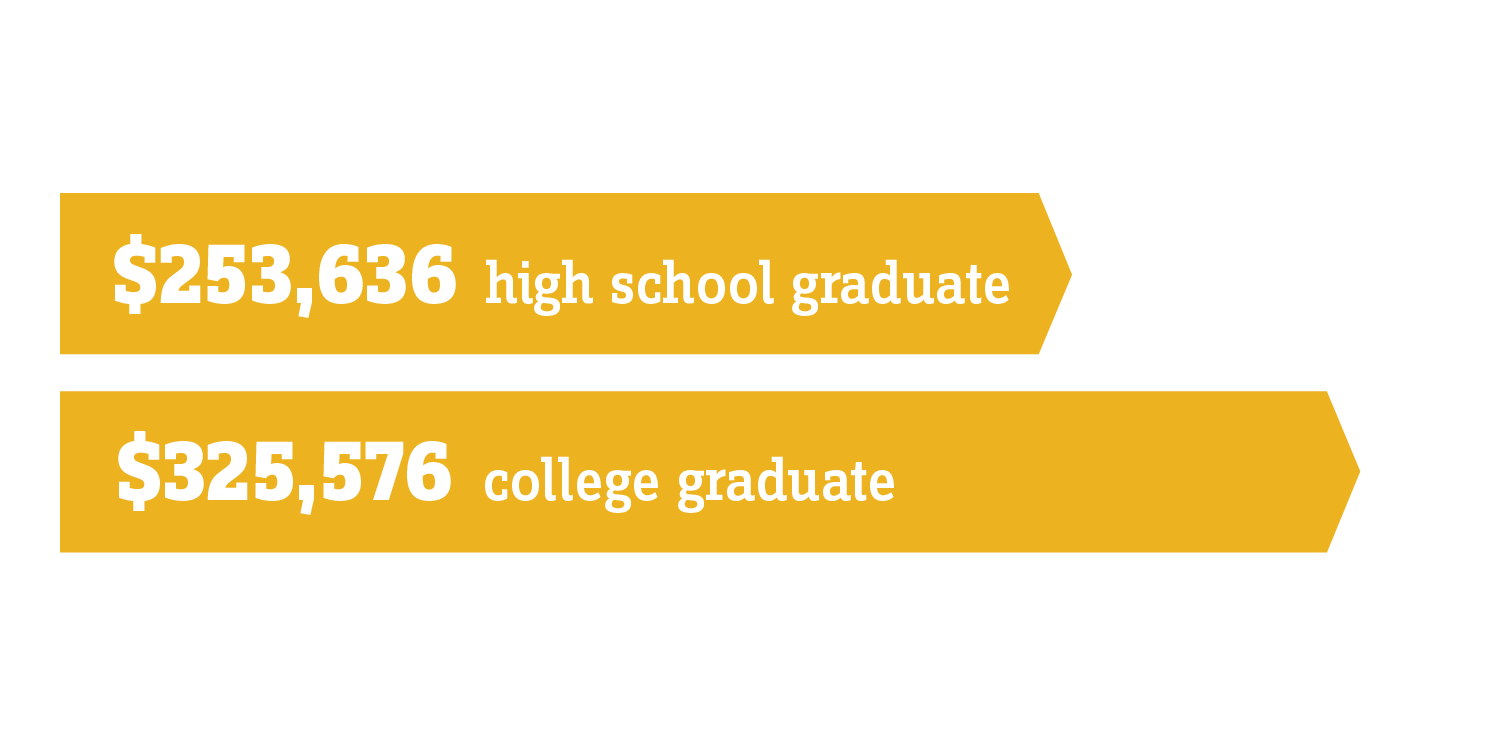

But overall, the data is pretty clear: By the age of 35, a college graduate will be about $71,000 ahead of a high school graduate, even with their tuition payments and years they may have spent in school instead of in the workforce.

That’s according to the Urban Institute, which published one of the more rigorous examinations of the cost-reward balance for college degrees. According to their report, the “break-even point” averages about eight years after college graduation.

Breaking Even

Average cumulative earnings of a high school graduate vs. a college graduate at age 35.

Intangible Benefits

Of course, the decision to seek a college degree is more than a dollars-and-cents question. College is a place where many students learn for the

first time how to live independently, manage their workloads effectively, and form new social and professional networks. They also often gain the intangible skills that employers consistently deem most valuable: work ethic, self-motivation, teamwork, and communication.

These intangible benefits may be priceless.

When Desiree Kendall ’05 graduated Pacific with a degree in social work, she owed $24,000 to lenders who helped finance her education. She came from relatively fortunate circumstances and never skated too close to financial danger. After consolidating her undergraduate loans, she began repaying about $150 a month.

She’s worked as a social worker, a nanny, an elder caregiver, and a special education associate, and she’s now a stay-at-home mom in Laporte, Colo. She looks back on her time at Pacific with unalloyed appreciation.

“The experiential capital that I was able to gain at Pacific was huge,” said Kendall, who was a wrestling national champion and ve-time All- American, studied a semester in France and served as a student ambassador to prospective students and their families. “I have a hard time not being positive about Pacific.”

Lasting Impact

Though individual experiences vary, in general, the data is clear on one thing: A college education offers the greatest potential socioeconomic reward to students whose families have the highest to climb.

About 30 percent of Pacific undergraduates receive Pell Grants — federal grants for students from low- income families. A quarter of Pacific students are the first in their families to attend college.

Students at Pacific have a 16% likelihood of moving up "two or more income quintiles."

Sarah Phillips, the dean of the College of Arts & Sciences, says Pacific works hard to help boost students from all socioeconomic backgrounds — from those who are comfortably well off to those who are stretching to attend college. For example, she said, when faculty members take students on short-term travel courses, such as two weeks in Europe, the group invariably includes a student or two who has never own before.

In their study “Mobility Report Cards: The Role of Colleges in Intergenerational Mobility,” investigators with Harvard-based Opportunity Insights found that Pacific fares well in terms of socioeconomic mobility, relative to other private Northwest colleges. Tax data compiled by the Opportunity Insights researchers shows students at Pacific have a 16 percent likelihood of moving up “two or more income quintiles.” That’s better than the rates at Linfield, Lewis & Clark, George Fox, Willamette, Pacific Lutheran and other regional schools.

Faculty member Jaye Cee Whitehead ’00, also a Pacific alumna, explains that her students’ experiences often mirror her own as a first-generation college student from rural Wyoming.

“My story is the story of Pacific — and it is centrally about social mobility and community responsibility,” she told donors at a special event this winter. “More than any other college in our region ... we launch more students into the middle and upper-middle class.

“I have heard people call college a transformative experience, and I’m sure folks mean many different things when they say that. But to me, Pacific changed the trajectory of not only my life, but of my entire family line — generations to come.” ■

This story first appeared in the Spring 2019 issue of Pacific magazine. For more stories, visit pacificu.edu/magazine.